Cryptocurrencies are mingled as one entity in people’s lives. Digitalization is the key element that contributes to bringing the vibe of cryptocurrency among people. As common people, we accept cryptocurrencies as a footpath for replacing the current finance system with a fortune digital system. We know that the first and most traditional cryptocurrency is bitcoin. Bitcoin is an open-source decentralized digital currency that removes the need for a central authority or organisation like a bank. They work based on the Proof of Work (PoW) consensus algorithm.

In the digital world, we have a lot of resources to understand the past of bitcoin. In the meanwhile, there is an epic struggle happening to make us believe the fall of the bitcoin world. But the question that arises here is, Are they really vanish in the future? or Are they dramatised as true through buzzes? Let us find the answers to these questions here.

History of Bitcoin

Before delving into the investigation, it is good to reveal the history of bitcoin from its origin point. Because having proper research is way better than believing a buzz blindfolded. Come let us rewind the history shortly. In 1983, American cryptographer David Chaum conceived the concept of cryptographic electronic money in the name of ‘ecash’. In 1995, crypto was implemented through ‘Digicash’. In 1997, the minting concept was established and as a continuation, in 1998 it was described as ‘b-money’.

And finally, in 2009, a pseudonymous developer Satoshi Nakamoto created ‘bitcoin’ which is the foundation of all cryptocurrencies. After crossing a lot of regularisation barriers, bitcoin stands out here as a game-changer. Well! History denotes that bitcoin has an uneven passage from its discovery to its current definition. So, it is confirmed that the bitcoin market will boom in the near future. As proof of the truth, more bitcoin-based businesses are arising nowadays.

It is a well-known fact that the value of bitcoin should be based on the demand and supply in the marketplace. Acknowledging that, whenever the news circulated about the fall of the bitcoin value, the bitcoin market also experiences downsides. And vice versa, the bitcoin market goes up. It is clear that the circulation of false information directly impacts the market value of bitcoin.

Bitcoin Price Prediction analysis

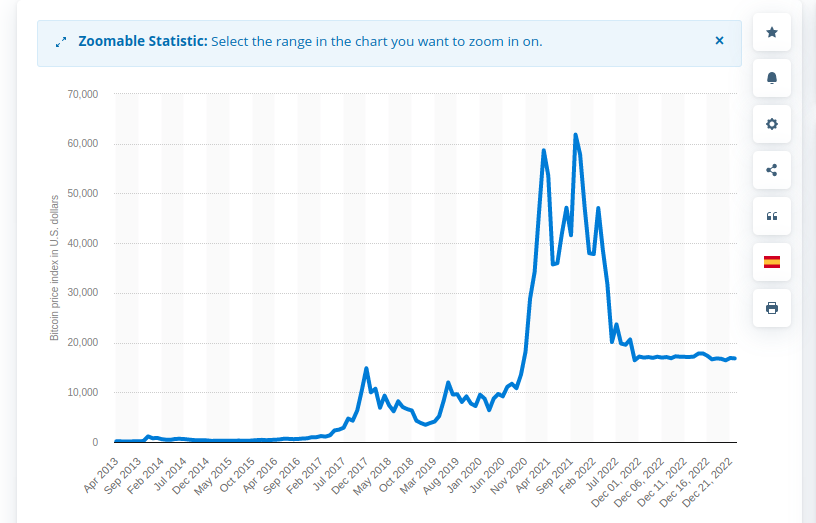

Let us have an in-depth analysis that can give you more clarity on the bitcoin price prediction. For that, I have taken factors to examine the state of bitcoin from its launch. They are bitcoin price analysis and bitcoin return value analysis. First, we start with the bitcoin price analysis.

The real-time data of bitcoin price reveal the state of the bitcoin price from its launch. For that, I have gathered bitcoin price data from online resources starting from its launch year to till date to examine the surge in the bitcoin price. Let’s start the price analysis year by year.

Bitcoin in 2009

Bitcoin may be processed to launch in late 2008. But officially, it was launched on January 3, 2009, by a pseudonymous developer Satoshi Nakamoto. Similar to all cryptocurrencies, the value of bitcoin also be $0.00 when it is launched. Since bitcoin is decentralized in nature it was not listed in any crypto exchanges and there is no interest among investors to trade bitcoin. Bitcoin’s popularity among users has slowly risen in the year of 2010.

Bitcoin in 2010

The bitcoin price slightly got a rise from 2009 to 2010. According to an online source bitcoin.com, the value of bitcoin was $0.09 in July 2010. The first bitcoin exchange BitcoinMarket.com was launched in 2010. Do you know there is an interesting thing about the price of bitcoin in 2010? That is, a Floridian programmer spent 10000 bitcoins for buying two large-size pizzas in May 2010. Now the value of 10000 bitcoins is equal to $168395000.00. It is one of the pieces of evidence to judge the rise of bitcoin’s value.

Bitcoin in 2011

The bitcoin price touched $1 for the first time in February 2011. The price had hit nearly $30 by July 2011. Litecoins are introduced based on the open-source platform of bitcoin in the last of 2011. At the same time, the price of bitcoin also slashed to $2 at the end of 2011, which is almost a 90% drop in market value. At that time most finance experts believed that the bitcoin market would never grow further. But things started changing there from 2012 onwards.

Bitcoin in 2012

In 2012, bitcoin slowly and steadily focused on market improvement. It gained popularity better than in its prior years and got stronger in the market in November 2012. As a result, the bitcoin price started at $2 peaks at $13 at the end of 2012. Consequently, following a price drop in 2011, bitcoin attain its growth in 2012 creating more trust among people to get them engaged more in bitcoin.

Bitcoin in 2013

The year 2013 was a remarkable year in the history of bitcoin. The bitcoin price peaked further at $20 in January 2013 and reached up to $40 at the end of March 2013. While, at the same time, European countries experienced financial crises which turned people’s trust towards investing in bitcoin away from the traditional banks. By the start of April 2013, the bitcoin price reached $100 for the first time and within a few days it peaked at $230.

After facing a lot of growth and crashes, at the end of November 2013, the bitcoin price was at around $1,200 and finally settled at around $700 at the end of December 2013. So according to these data, you may be clear that the fall of bitcoin price is the beginning of its unpaired growth.

Bitcoin from 2014 to 2016

In 2014, bitcoin’s value faced a lot of ripples; and at the end of the year, its price settled at around $320. Bitcoin ranges its way as the acceptable payment method in the majority of business sectors including the banking sector. As a result, bitcoin has gained more hikes in the years 2016 and 2017. But it never sat down and it rises up with double the growth in the coming years.

Bitcoin in 2017

Again in 2017, the bitcoin growth resembles the year 2013. The peak wave again returns in the year 2017. The price of bitcoin only faces upstream which creates a lot of milestones in the year 2017. Starting with the price of $1000, bitcoin attained a peak of around $14000 in December 2017.

Bitcoin from 2018 to 2020

It is the unwritten practice that every field has its ups and down. Bitcoins are not exceptional too. In 2018, it faces downstream and in 2019 it faces upstreams and in 2020 it again revamps to newer heights. So at the end of 2020, the price of bitcoin settled at around $28000.

Bitcoin in 2021 to 2023

The start of 2021 continues the progress of 2020 and at the end of February 2021, the bitcoin price seated at around $47000. The growth surge again reaches its peak in October 2021 at around $62000. And in 2022 the bitcoin price slowly falls down and at the beginning of 2023, right now the price of bitcoin settled at around $17000.

Source: Statista Bitcoin prediction from April 2013 to Dec 2022.

So, analysing the real-time price data recorded from 2009 to till date it is proved that the bitcoin price has a periodical rise and fall throughout its journey. Bitcoin has shown a steady rise whenever it falls a little bit. The source chat also supports our gathered data regarding bitcoin prices from April 2013 to December 2022. So from the price analysis, it is clear that, with every fall in price, bitcoin’s growth is rebuilt beyond its prior outreach.

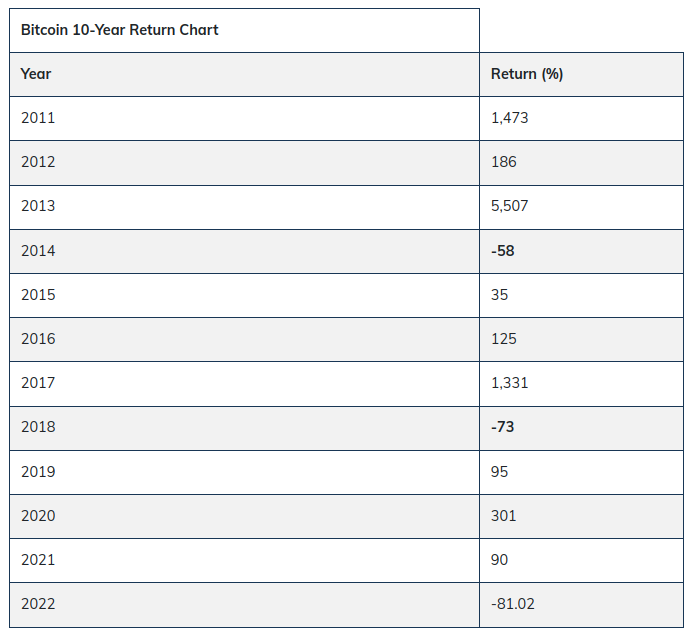

Now, let us start the second analysis – the bitcoin return value analysis. It is also important to consider bitcoin’s return value while predicting bitcoin’s future. For that, I have taken two online sources of the bitcoin return value. Let us have a different view of the investigation in this.

The following tables show the price and return percentage of bitcoin estimated with real-time bitcoin price in two different financial websites.

Source: goodfinancialcents.com bitcoin annual return

bankrate bitcoin returnSource: bankrate.com bitcoin price history

Both tables show the year-wise change in bitcoin return value in percentage. Considering the table values, we can see the difference in the bitcoin return value for every two to three years. Let us start with the year 2011. In the years 2011 to 2013, the percentage of bitcoin return value varies from year to year. But the registered bitcoin return value confirms the growth in bitcoin price. The data based on bitcoin price also resembles the same.

Similarly, in the year 2014, both tables show the negative impact on the bitcoin return value. The gathered bitcoin price data and source chart also support the same negative impact on the bitcoin price.

Now coming to the point, after every fall in bitcoin price and bitcoin return value, there is a huge rebuild of the bitcoin market. These bitcoin return value tables data also confirm the same. For example, let us take the data from the year 2015 to 2017. It is clear that from 2015 to 2017, the bitcoin return value is in a growing stage and it peaks in 2017. The bitcoin price data and source chart also confirm the same.

So, from both the bitcoin price and return value analysis, it is evident that the bitcoin price should vary based on demand and supply in the market. In the meantime, the analysis report reveals that the drop in bitcoin price will be a symptom of the rise of bitcoin’s price in the near future. On the other hand, it is also clear that the false information about bitcoin’s drop also impacts bitcoin’s growth in the market. Moreover, there is no relationship between the temporary drop in bitcoin’s price to its future price.

So, the intro question: Will they really vanish in the future? or Are they dramatised as true through buzzes? got the answer as follows,

- Will they really vanish in the future? – Definitely not. The current fall of bitcoin is completely temporary and it is normal too. Bitcoin experts also confirm the same.

- Are they dramatised as true through buzzes? – Definitely Yes. To oversee the loyal growth of bitcoin.

In addition to that, experts from the group of financialists also accept that it is not the right time of defining the character of bitcoins. Because the history of bitcoins hasn’t ended and it has a long to compose up further.

Is it safe to invest in bitcoin? What will be the price of bitcoin in 2023?

The straight answer to the question is definitely yes. It is a completely safe and good investment for your future needs. You may hesitate to invest in bitcoins because of the surge in bitcoin’s price and the rumours concerning the future of bitcoins. Isn’t it? Fine! Let me explain.

It is a good practice of analysing before making an investment. Please keep in mind that, the bitcoin price may flow up and down based on some factors. But it never vanishes from the market certainly. The change in bitcoin price is completely based on its demand and supply in the market. The loyal presence and the past market value of bitcoins are proof of their future existence.

Moreover, most countries experience monetary inflation right now. Developed nations like US and UK are also countries among them. Because of inflation, the bitcoins’ supply gets affected indirectly as people are not ready to invest in anything right now. Hence, bitcoins also face declining growth in the crypto market. Financial experts also depict that, this economy fall will back to rising in near future.

Along with that, the total availability of total bitcoins is at around 21 million. Out of which around 19.2 million bitcoins are only in use to date which is approximately 92% of the total supply of the bitcoin market. It is predicted that the last supply of bitcoin will be in 2041. So, bitcoin will be in circulation even after 2041.

So, it is clear that the current recession in the bitcoin market is completely temporary and has nothing to worry about. Hope you may ease the reluctance of investing in bitcoin. Now let me give you the importance of investing in bitcoin.

- Bitcoin is one of the world’s old cryptocurrencies that have global market value and offer lower transaction fees. So, you can trade bitcoin in any of the global crypto exchanges easily.

- Generally, cryptocurrencies are suitable for long time investments due to their market demand. But bitcoin offers high liquidity which enables you to get a better outcome in a short time.

- Like any other cryptocurrency, bitcoin introduces new currencies frequently which should reflect the market demand for bitcoin. Hence you may get good market value for your bitcoins forever.

These are all important things you should consider before investing in any crypto. Now coming to the price prediction of bitcoin in 2023.

You may aware of the bitcoin halving if you are a bitcoin enthusiast. Bitcoin halving is nothing but it is an event that cut down the reward of bitcoin mining by half. It happens once every four years. The main focus of halving is to reduce the rate of bitcoin inflation.

According to price prediction analysis, there will be a hike in bitcoin value after every bitcoin halving takes place. Like 2017 gets a hike in bitcoin price after bitcoin halving done in 2016. As bitcoin’s market experienced a drop in 2021 and 2022. And hence it is predicted that the price of bitcoin will reach too high in 2023. According to online sources, the bitcoin price is to reach a maximum level of $28,292.18 with a minimum price of $24,613.06 at the end of 2023.

Concluding thoughts

It is true that no one can predict the price of bitcoin perfectly; even bitcoin experts can not do it. Based on the current data, there is a lot of bitcoin mining tool development is in progress. So, it is confident that the bitcoin reach will further increase in future. According to my prediction, if there is no inflation in the bitcoin market and the price is continuously pushing upward, the price of bitcoin will be between $25,000 to $33000 at the end of 2023. It is certain that, after bitcoin halving in 2024, its price should increase further. Hence investing in bitcoin is the right choice for entrepreneurs. So, I recommend you avoid such fraudulent information and start investing in bitcoin with a hopeful mind.